During the Financial Engineering course A.Y. 2022/2023 held by Professor Roberto Baviera, the fourth edition of the ‘Best Pitch’ contest was organized. In this framework, students had the opportunity to present their Final Projects employing a tool that is increasingly prevalent in the financial industry: “the Pitch”. Previous editions can be found here (1st, 2nd and 3rd). This award has been followed by the 5th edition for the AY 2023-2024.

The term “Elevator Pitch” is commonly used to describe the Pitch, which is intended to be a concise presentation lasting 3 minutes. Its purpose is to convince an investor within the limited duration of an elevator ride. Considering that time is a scarce resource for both managers and clients, a skilfully crafted Pitch becomes vital in capturing clients’ interest and prompting them to inquire further. The fundamental components of a Pitch encompass the introduction of the problem that needs solving, an outline of the proposed solution(s), and a conclusion emphasizing the innovative aspects and crucial points.

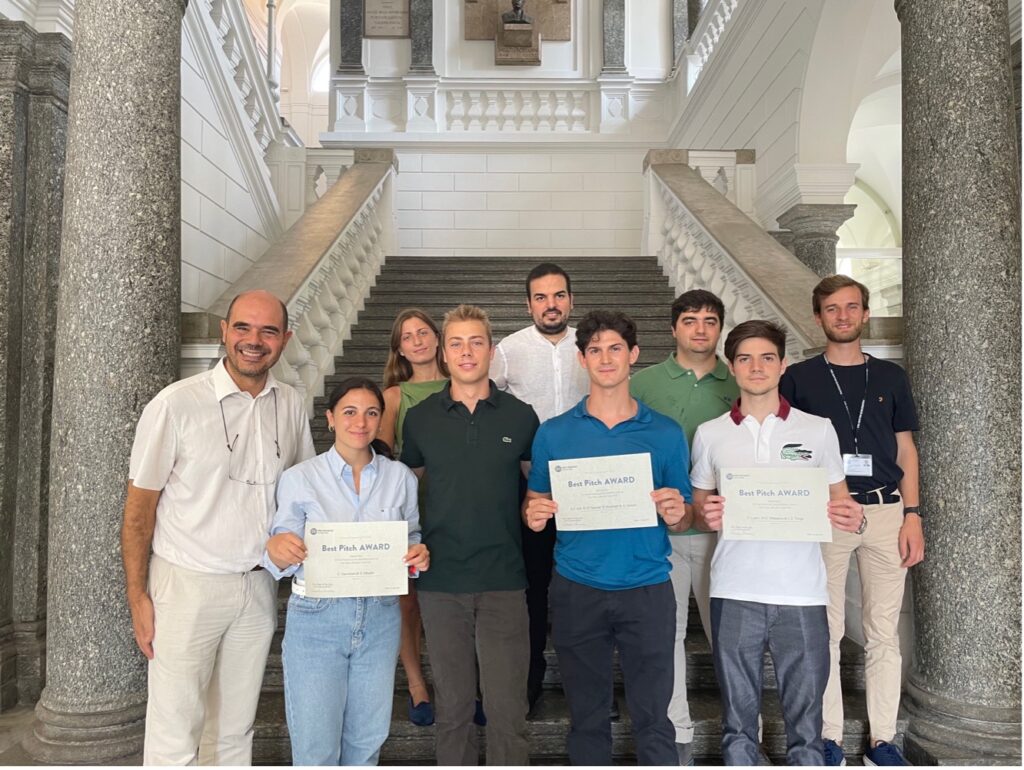

A total of 26 groups participated to the competition. Each team presented their individual pitch, introducing the topic they were tasked with and subsequently elaborating on the methods and results of their analysis. On the designated day each group delivered their Final Project presentations to a jury consisting of fellow students from the course, professionals actively involved in the financial industry, and esteemed academics. Among all of them, three exceptional ones stood out as the most creative, innovative, and compelling. In the following, we showcase these remarkable selections (in sparse order).

The winning projects of the ‘Best Pitch Award A.Y. 2022/2023’ are:

OU-Lévy and Lévy-OU Simulation for option pricing

The aim of the project is to create a library for the simulation of two general classes of mean-reverting stochastic processes, called Ornstein-Uhlenbeck-Lévy and Lévy-Ornstein-Uhlenbeck: in the energy and commodity markets, where strong mean reversion and sudden spikes are common, Lévy-driven OU processes prove to be more suitable than the standard Gaussian framework. In this project, two types of simulation have been implemented: the exact one and a faster Monte Carlo one. The two types are then compared in terms of computational time and accuracy on prices and on distribution cumulants.

by Pietro Ferdinando Alfì, Saad El Haimar El Boukhari and Alice Iamoni

Ref. Paper: A fast Monte Carlo scheme for additive processes and option pricing. Azzone & Baviera, 2023. Computational Management Science, 20(1), 31 (open access article).

Rating Momentum in Credit Migrations

We model the rating migrations of the obligors of the Default & Recovery Database of Moody’s -a database that presents the rating history of many obligors- by using two models: a Continuous Time Markov Model and a Hawkes Process, where the latter is a non-Markov model that allows downward momentum. Both the models have been i) calibrated via the log-likelihood maximization and ii) simulated to reproduce several ‘replicas’ within a bootstrap technique, thus being able to construct confidence regions for the relevant models’ parameters.

by Filippo Lipari, Michele Massaria and Luca Emanuele Targa

Ref. Paper: A note in rating momentum in credit migrations. Baviera & Fiumi, 2023, in preparation.

Three-factor Interest Rate Models

The aim of this project is to produce a forecast of the yield curve starting from IRS mid rates, comparing the forecasting ability of two different models. In the first case, we model the curve via the three-factor Nelson-Siegel model, while in the second case we implement a Principal Component Analysis keeping only the three largest principal components. The forecasts are then obtained by evaluating the factors and the principal components as univariate AR(1) processes, and the best model is determined by comparing the forecast errors.

by Carlotta Cacciatori, and Stefano Meschi

Ref. Paper: Diebold & Li, 2006. Forecasting the term structure of government bond yields. Journal of Econometrics, 130(2), 337-364.